Recent years have witnessed the rise of cyber attacks on companies globally. Today’s businesses are faced with cyber threats like ransomware, phishing, brute force attacks, etc. and these attacks bring losses of millions of dollars! It has become a norm to opt for proper cyber insurance to protect your business from the losses caused by these threats, but it is of no use if you don’t have a proper security measure in hand. Multi-Factor Authentication (MFA) is a robust security measure that will add an extra layer of security to your systems and help you comply with many top cyber insurance policies.

What is Cyber Insurance & why MFA is required for Cyber Insurance Policies?

Cyber insurance or cyber risk insurance is a policy that offers coverage for losses and damages resulting from cyber security incidents. Whether it’s investigating a breach, covering legal fees, or compensating for lost income, the cyber insurance policy can help businesses recover from a cyber attack. But what is a threat in cyber security, exactly? Simply put, it’s any potential danger that could compromise your sensitive data or systems.

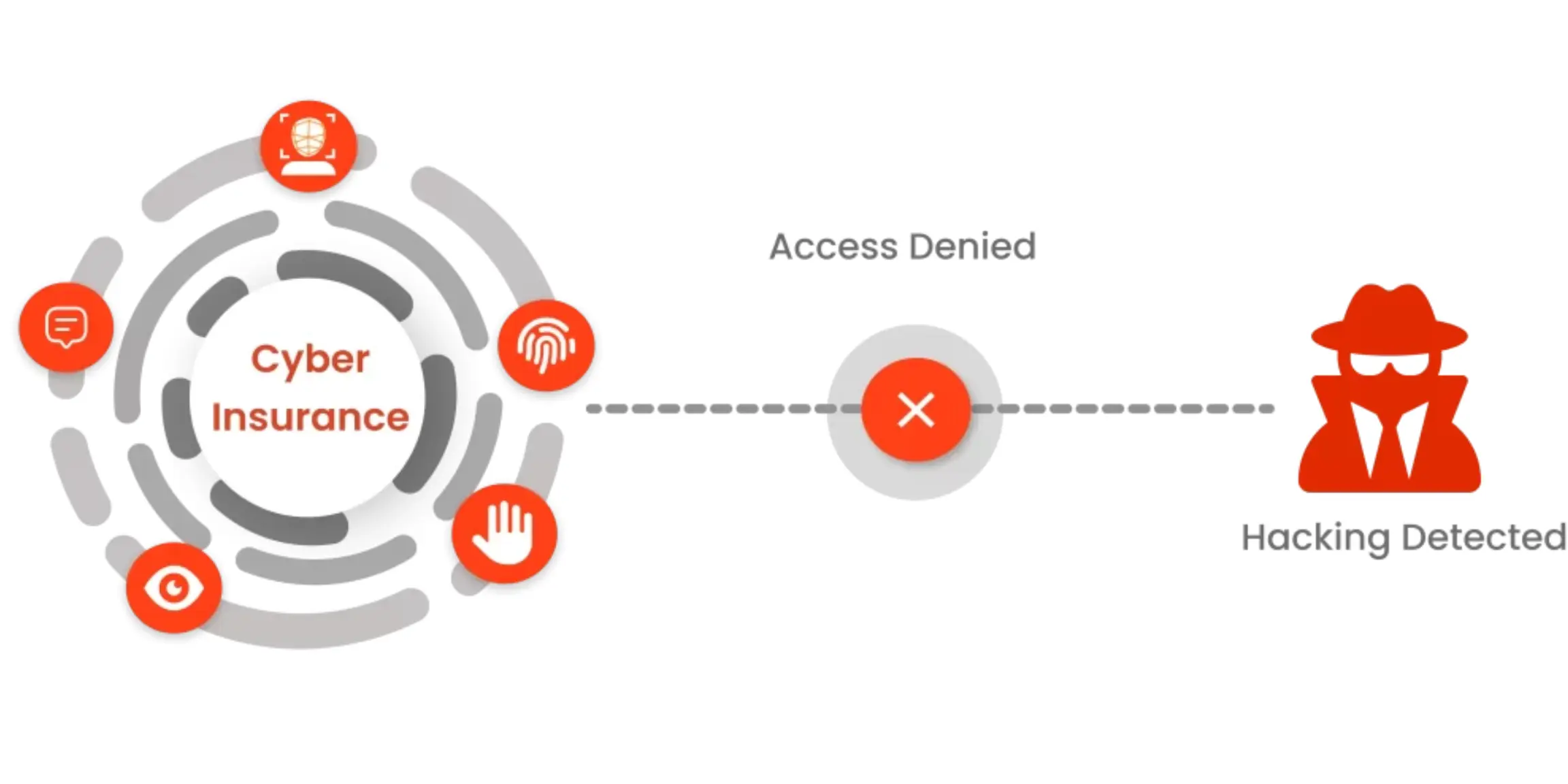

Here MFA acts as a robust security feature that adds an extra layer of security to your systems and keeps your data safe. MFA is becoming increasingly important in cyber insurance policies as more businesses move their operations online. The risks of cyber attacks are higher than ever, and cyber insurance policies without MFA may not provide enough protection. By including MFA in a cyber insurance policy, businesses can reduce their risk of cyber attacks, and insurance providers can offer more comprehensive coverage options.

What are of Benefits of Using MFA with Cyber Insurance?

Here are some key points to consider when thinking about the benefits of implementing MFA along with cyber insurance:

- Optimizes cost of cyber insurance premium: Insurance providers view MFA as a crucial security measure that can help prevent data breaches, making businesses less risky to insure. By implementing MFA, businesses can potentially reduce their insurance premiums and save money in the long run.

- Ensure Compliance: Many cyber insurance providers require insurers to comply with some regulations & compliances. Implementing MFA can help businesses meet these requirements and be eligible for top insurance policies.

- Prevent Security Breaches: While cyber insurance can help cover the costs associated with a breach, it can’t prevent the breach from happening. By implementing MFA, an extra layer of security is added which prevents information security threats and cyber attacks like unauthorized access, ransomware, phishing, etc.

Choosing the Right Cyber Insurance MFA Policy

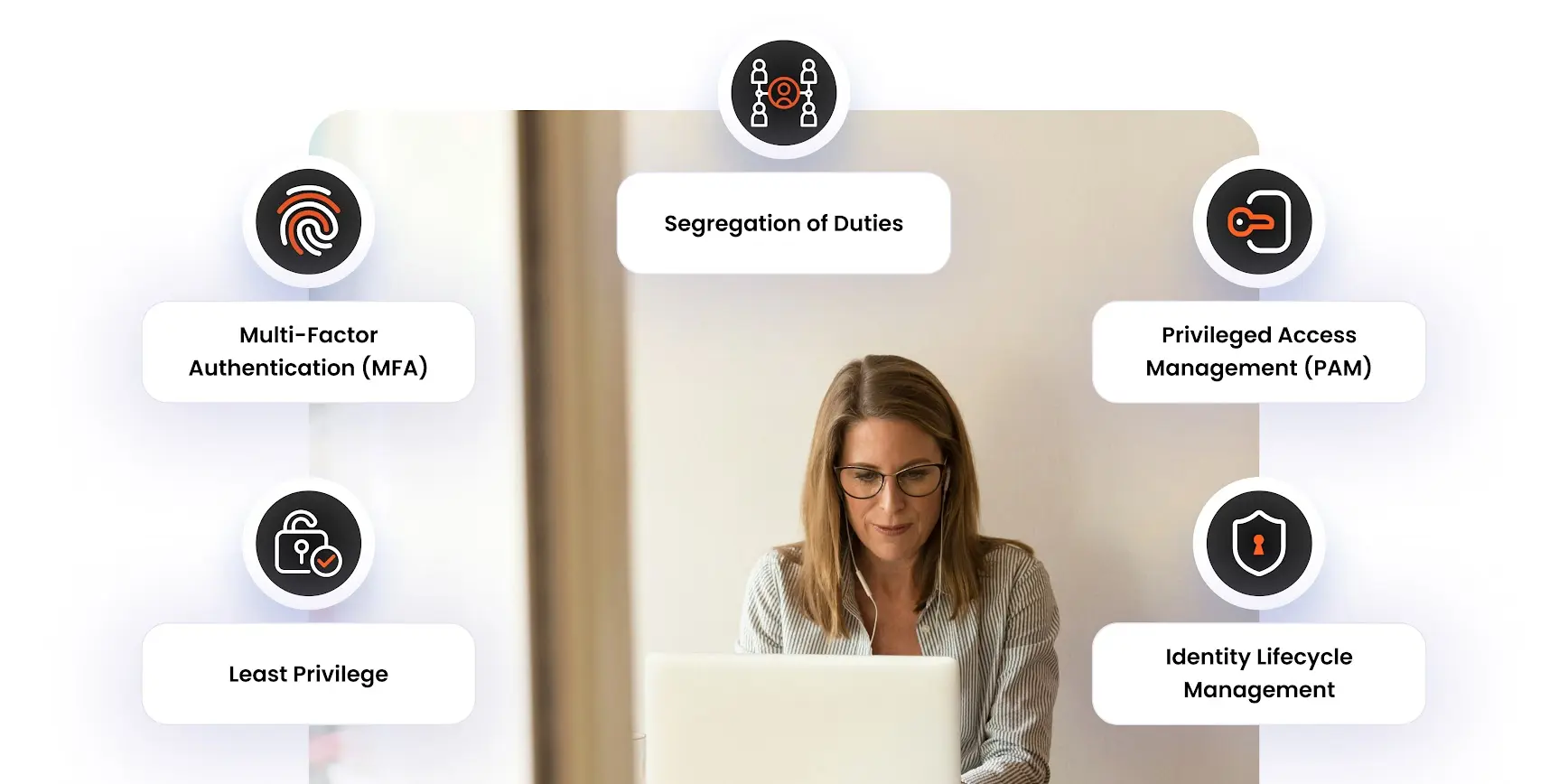

When choosing a cyber insurance policy with MFA, it’s important to consider the specific MFA techniques included in the policy. Biometric authentication, token-based authentication, and SMS-based authentication are all effective MFA techniques that can be included in a policy. Additionally, it’s important to consider how MFA can be used to secure both internal and remote access to company resources.

The Role of Insurance Providers in Promoting MFA

Insurance providers can play a crucial role in promoting MFA and helping businesses implement MFA techniques. By partnering with cybersecurity companies, insurance providers can offer MFA as part of their policies and provide businesses with the necessary tools and resources to implement MFA effectively.

Understanding Cyber Insurance and Why It’s Important

While cyber insurance MFA can help secure your business against cyber attacks, it’s important to understand the basics of cyber insurance and why it’s important. Cyber insurance policies typically offer coverage for data breach response, business interruption, and cyber extortion, among other things. By having a cyber insurance policy in place, businesses can recover more quickly from cyber attacks and reduce their financial losses.

Maintaining a low-risk score is essential for businesses seeking cyber insurance MFA policies. A low-risk score indicates that a business has effective cybersecurity measures in place, making them less vulnerable to cyber-attacks and therefore less likely to make a claim on their insurance policy. To maintain a low-risk score, businesses should implement MFA techniques, such as biometric authentication or token-based authentication, to secure their systems and resources. Additionally, regular security audits, employee training, and incident response planning can all contribute to maintaining a low-risk score and ultimately reduce the cost of cyber insurance policies.

How miniOrange helps in Cyber Insurance MFA?

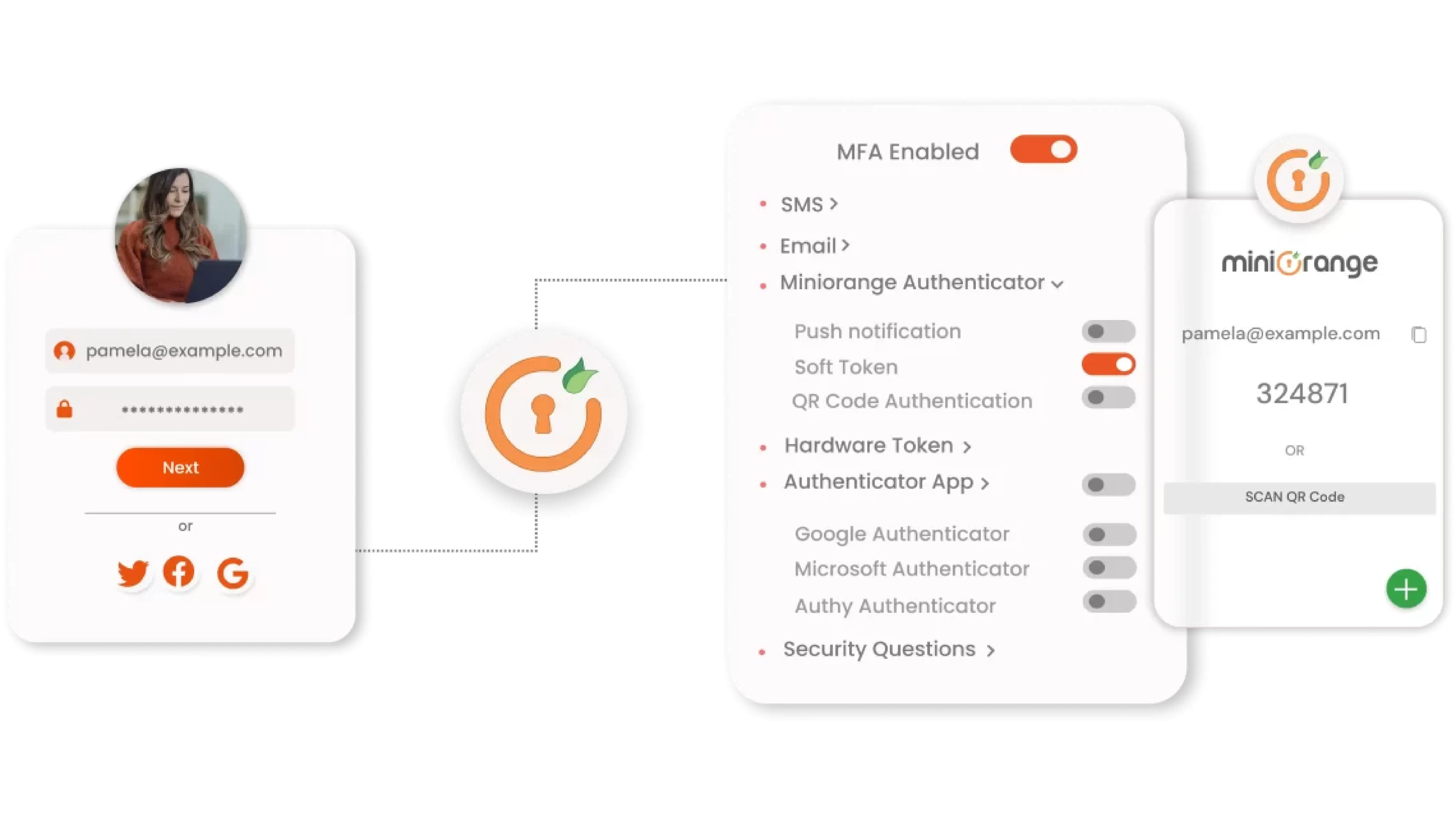

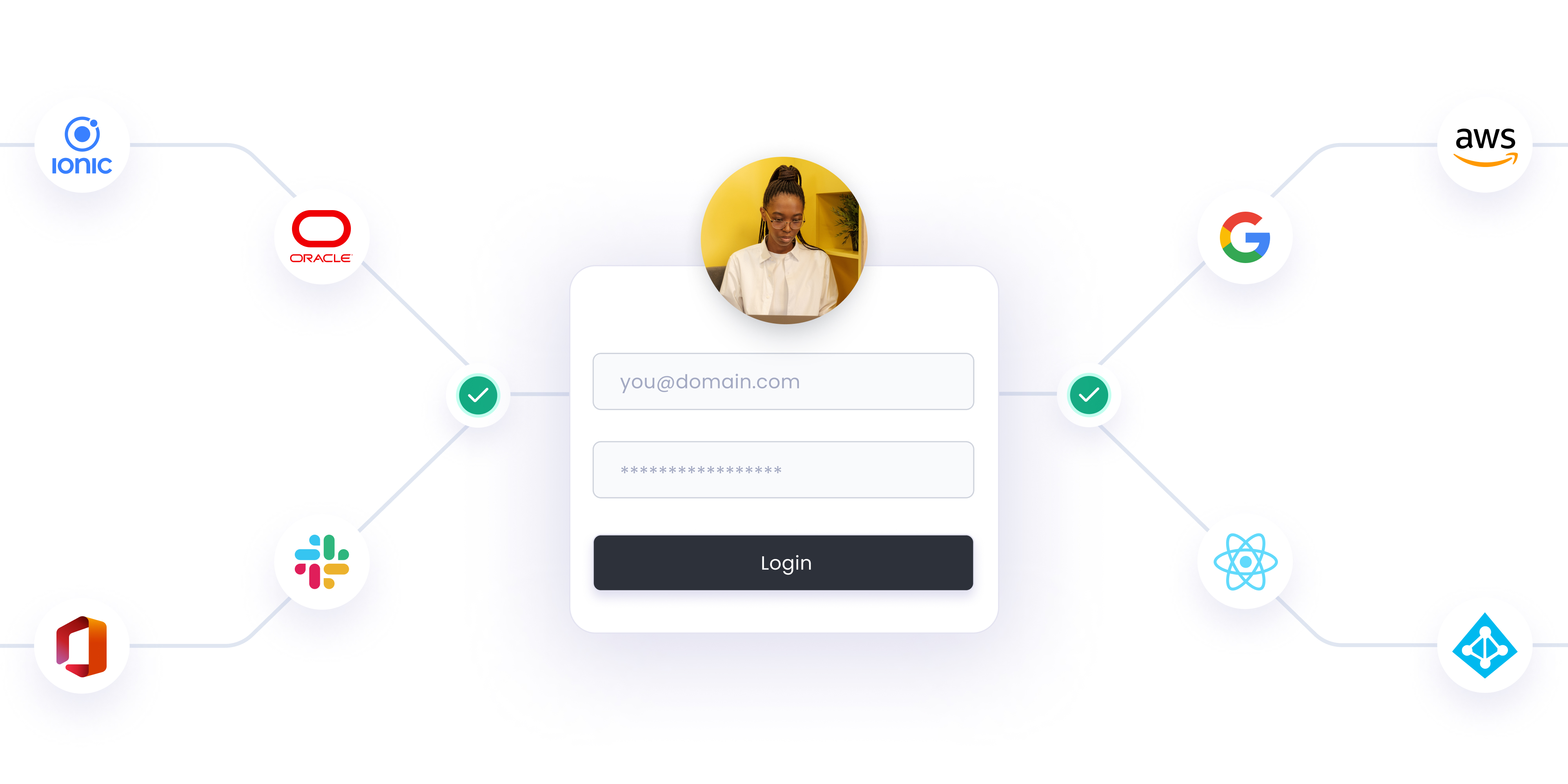

miniOrange MFA is a powerful solution for implementing multi-factor authentication to enhance cybersecurity measures. With miniOrange MFA, businesses can ensure that their systems and data are protected against unauthorized access, reducing the risk of cyber attacks.

miniOrange MFA supports a wide range of network authentication methods, including SAML, OAuth, OIDC, JWT, and Radius, making it easy to integrate with existing systems. There are several types of MFA available, including something the user knows (such as a password or PIN), something the user has (such as a security token or a smartphone with a specific app installed), and something the user is (such as biometric data like a fingerprint or facial recognition). With miniOrange MFA, businesses can choose from 15+ second-factor authentication methods, such as OTP over SMS, OTP over Email, Out of band SMS, Google Authenticator, and Microsoft Authenticator.

When it comes to cyber insurance policies, implementing effective MFA techniques is crucial for reducing the risk of cyber attacks and maintaining a low-risk score. VPN can provide protection but it is not enough to tackle modern cyber attacks. By implementing miniOrange VPN MFA, businesses can protect their remote access points, reducing the risk of cyber attacks and improving their chances of obtaining comprehensive cyber insurance coverage.

Conclusion

In conclusion, incorporating MFA into a cyber insurance policy can significantly improve a business’s protection against cyber attacks. By utilizing effective MFA techniques, businesses can lower the risk of cyber incidents, safeguard their data and operations, and recover quickly from potential security breaches. miniOrange offers state-of-the-art MFA solutions and Risk-Based Authentication, enabling businesses to fulfill their cyber insurance requirements.

If your cybersecurity insurance provider requires MFA, then miniOrange with its robust Access Control and Automated Account Management features can secure all services, including VPNs, cloud apps, and on-premises applications, and help you comply with all the regulations of your cyber insurance provider.

Author

Leave a Comment