As we all know that the financial services industry is comparatively more at risk of cyber attacks than any other industry. Among all the cyber-attacks taking place all around the globe, 45% are related to the banking cybersecurity (recent PWC survey) & the major reason behind these attacks is money! For the finance sector or overall financial institutions, authentication plays a very important role since they are dealing with other people’s money and very sensitive personal information.

It greatly emerged during the lockdown period when bank branches closed and the digital channel became the only option for consumers to perform banking tasks or to connect with their banks. In the last two years more and more people were turning towards e-banking, online attacks are creating a threat to security for banking rapidly. Such growing cyber attacks motivate banks to go for stronger authentication methods, other than using only general usernames and passwords.

Problems with Basic Authentication

- The use of single authentication (username & password) is a huge problem today. Users put themselves at risk when they use weak or recycled passwords, or compromise their own data security with unsafe behavior, such as sharing passwords.

- In substance, different applications and systems authenticate in several ways, so there will be a higher risk because whilst one system could also be very strong, another could also be weaker.

- The problem finance sector face is that users forget their passwords all the time which makes it a major issue for security for banking. Suppose, each retail teller had access to about 12 different systems and each one had a different password, so this meant they often forgot one or more passwords and needed to call IT for help.

How banking cybersecurity can be improved?

The act of conducting banking transactions through the internet is called e-banking. Prime Banks offers different online banking services to their users. They provide help to their customers to check his/her balance, make deposits, withdrawals, transactions, and even pay the bills from anywhere. This reduces physical visits to the bank, which enables serving more customers at a fraction of the cost and solves the issue of customer convenience. At such a situation security for banking services becomes necessary.By strengthening the banking cybersecurity and protocols of online banking by verifying customer identities with identity proofing and strong customer authentication, it would prevent unrestricted access to private information and further strengthen the relationship with customers and they can perform transactions with more reliability.

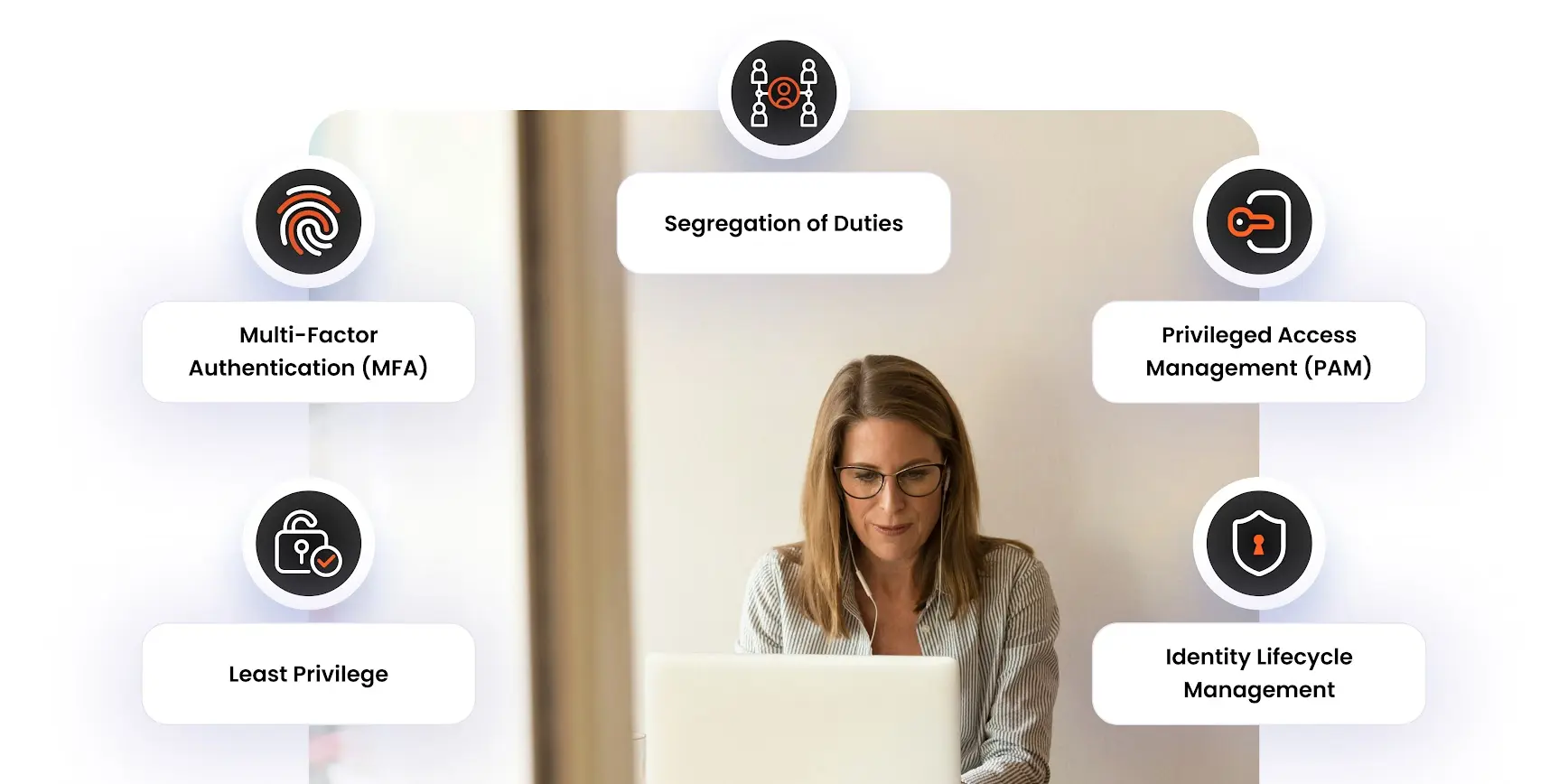

Authentication methods that depend on more than one factor are called multifactor authentication. They are stronger, more reliable and harder to compromise method of authentication than single-factor authentication. The Banking Cybersecurity policy is what determines the structure of their identity and access management (IAM) strategy, and which bank multi-factor authentication methods and best practices need to be implemented.

Multifactor authentication includes Security Q & A, SMS & email OTP, Hardware tokens, Software OTP, Push token, Smart card login, Biometric Authentication, etc. The user must provide at least two of the above factors to gain access to the account with a multi-factor authentication measure. This enhances banking cybersecurity by prohibiting hackers from gaining access beyond the password or pin.

So nowadays, many institutes are turning to modern authentication protocols. This includes multi-factor authentication, and orchestration hubs in light of the onslaught of data breaches, identity theft, phishing scams, malware, and account takeover incidents.

Finally, a good password policy and consistent enforcement is key and Single Sign-On is even better to increase security for banking!

How miniOrange can help Financial Services?

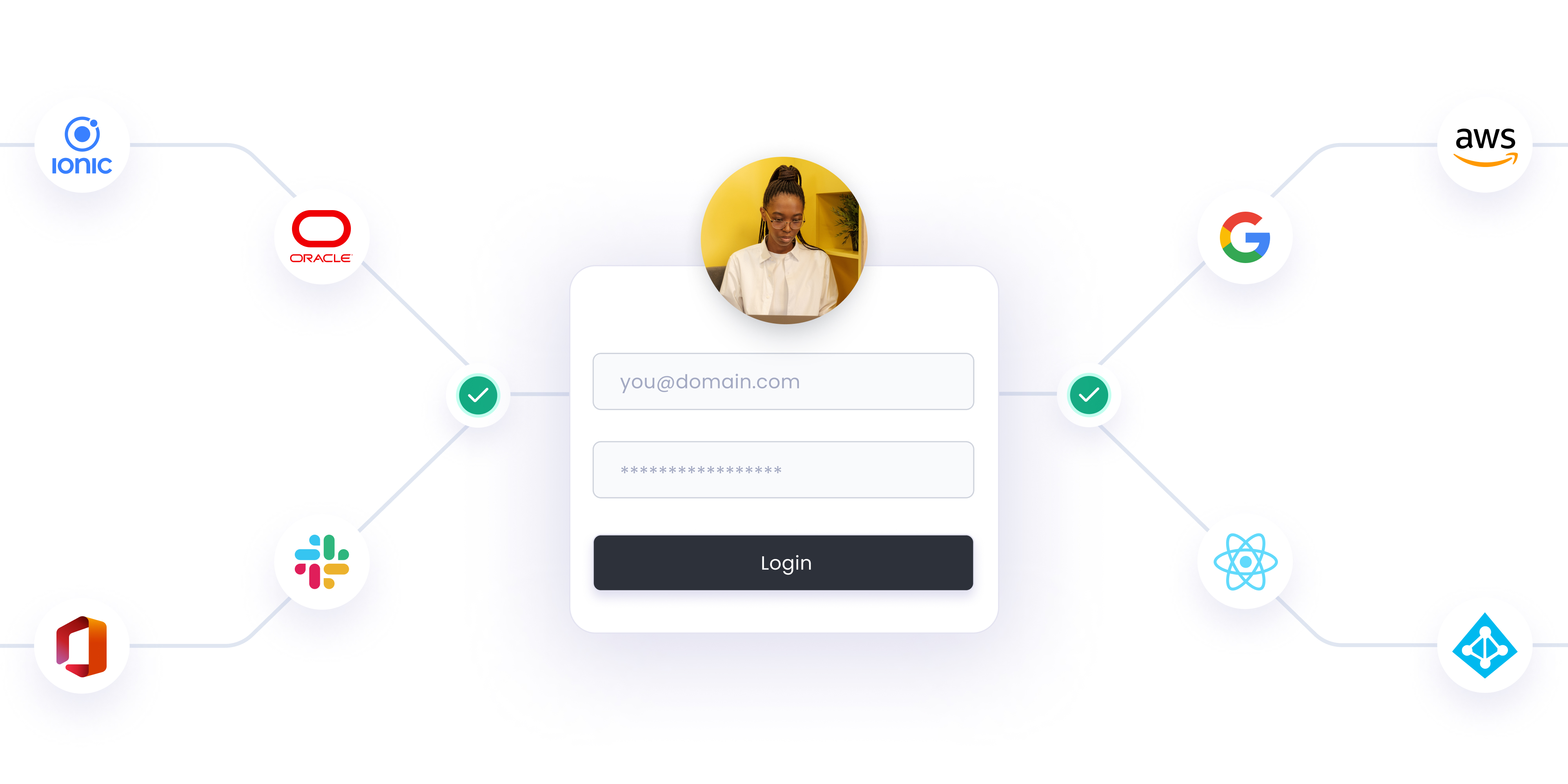

By enabling Strong Authentication, Fraud Prevention, and Single Sign-On solutions for Banking and Financial Services, miniOrange helps manage risks and comply with FFIEC regulations while providing comprehensive authentication solutions. Here are just a few examples:

Strong Authentication:

We help financial services solve various banking cybersecurity issues by leveraging its Strong Authentication solution and services. This will allow two or more components to authenticate a user or approve any online banking transaction – Authentication methods used could be OTP, Software / Hardware token, Out of band authentication or even a push notification, Face detection or Biometrics.

Single Sign-On:

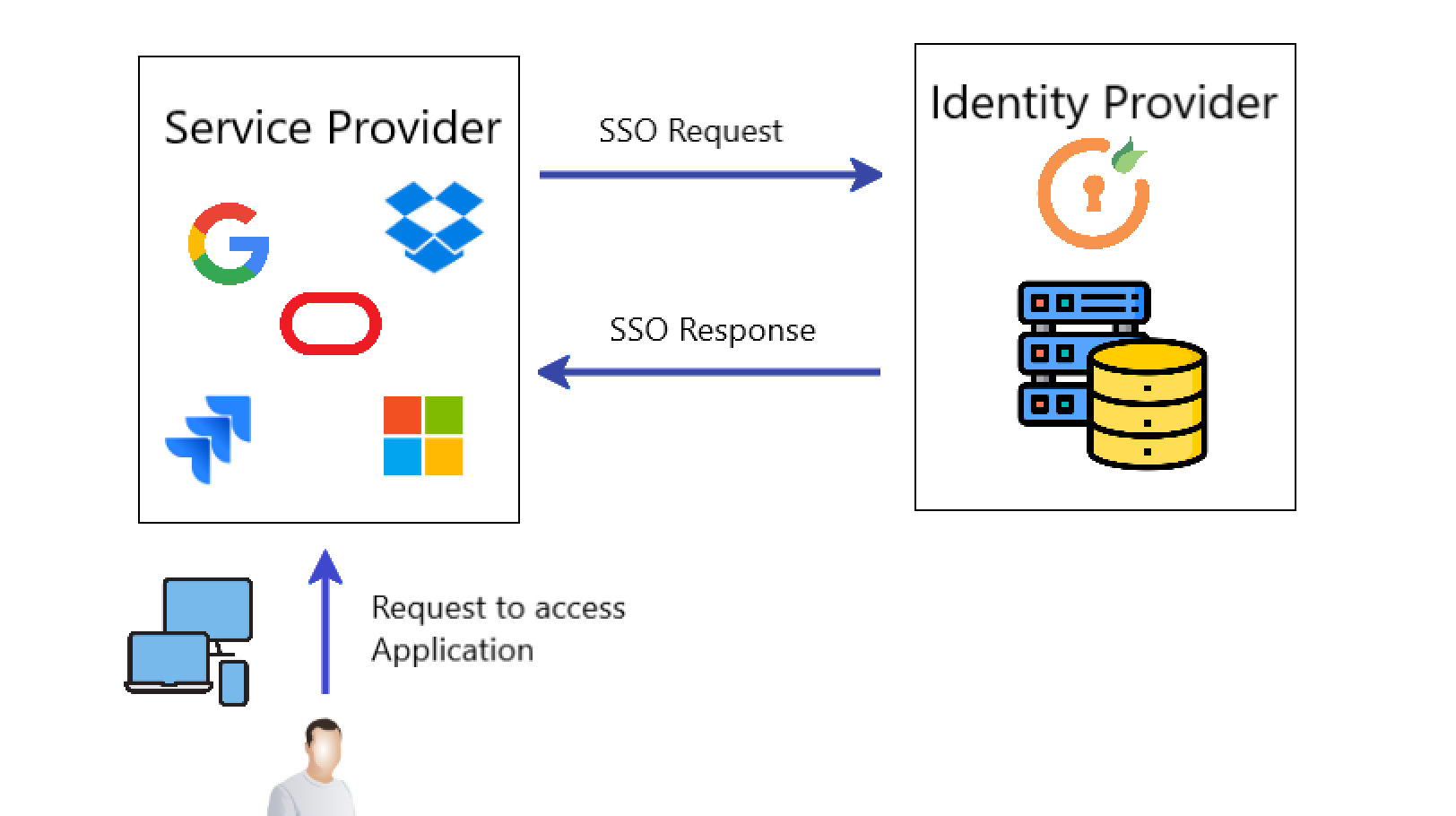

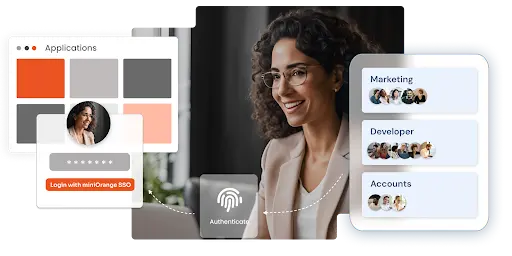

miniOrange Single Sign-On solution allows Banks to very elegant One Customer view in a very seamless manner. After authenticating with miniOrange SSO, bank users can easily access and navigate within numerous applications, such as Banking, Credit Card, and Payment apps, as defined by the bank. miniOrange SSO Solution deploys in minutes and supports a variety of cloud-based applications, web applications, and legacy apps.

Fraud Prevention:

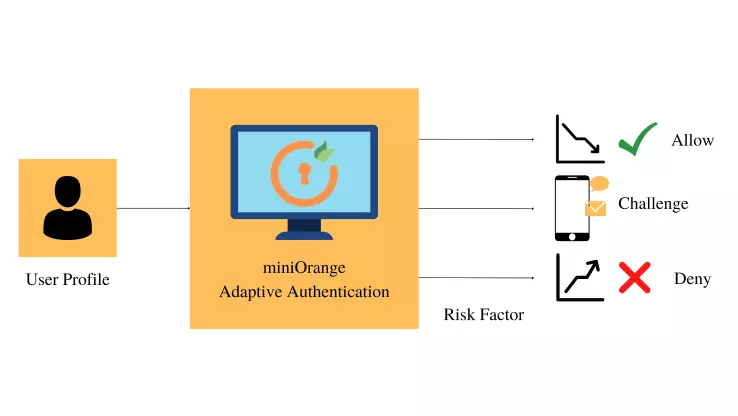

miniOrange Fraud Prevention product uses a behavioral risk based approach to minimize the risk of improper data access or loss of information. miniOrange Fraud Prevention applies the real-time analysis of incoming user requests for corporate information and prevents frauds with its dynamic risk engine in conjunction with enterprise-specific banking cybersecurity policy.

To Summarize

In reality, the threat to financial services from fraudsters was, is and always will be a major complication. Therefore, the financial service industry and strong banking cybersecurity must go together so as to provide a safe environment for the users. They must use updated tools according to the current environment so that security for banking & customer experience can be fulfilled.

Additional Resources

Author

Leave a Comment