In today’s digital age, the banking sector faces an ever-evolving landscape of cyber threats. To combat these threats and ensure the security of financial transactions, the SWIFT Customer Security Programme (CSP) framework has been established. This blog post delves into the intricacies of the SWIFT CSP framework, its significance in banking, and how miniOrange’s Privileged Access Management (PAM) solutions can help banks comply with these stringent security requirements.

Introduction to the SWIFT Customer Security Programme (CSP)

The banking industry is a prime target for cybercriminals due to the sensitive nature of financial data and transactions. To safeguard the global banking system, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) introduced the Customer Security Programme (CSP). This framework is designed to enhance the security of financial institutions by implementing a set of mandatory and advisory controls.

Why is it important?

In 2015, a bank in Vietnam was hit by a cyberattack on the SWIFT system, where attackers tried to steal a significant sum of money. By 2016, similar attacks increased worldwide, with the most serious breach targeting the Central Bank of Bangladesh, resulting in large fraudulent transactions.

To address these growing threats, SWIFT introduced new security measures in 2017. This included a set of mandatory and optional controls for all its customers. Every client is required to confirm they meet these security standards each year, and the results are shared with partners and regulators to ensure proper cybersecurity practices are in place.

Understanding the SWIFT CSP Framework

The SWIFT CSP framework is a comprehensive set of security controls aimed at protecting the SWIFT environment from cyber threats. It consists of both mandatory and advisory controls that financial institutions must implement to ensure the security of their SWIFT infrastructure.

- Mandatory Controls: These are essential security measures that all SWIFT users must implement. They establish a baseline level of security and are designed to address the most critical vulnerabilities.

- Advisory Controls: These are recommended best practices that SWIFT users are encouraged to implement. While not mandatory, they provide additional layers of security and help institutions stay ahead of emerging threats.

The CSP framework is built around three core objectives:

- Secure Your Environment: Protect the local SWIFT-related infrastructure, policies, and practices.

- Know and Limit Access: Manage and control access to sensitive systems and data.

- Detect and Respond: Implement measures to detect and respond to security incidents promptly.

Role of Multi-Factor Authentication (MFA) in SWIFT Compliance

Multi-factor authentication (MFA) plays a crucial role in improving security. MFA adds an extra layer of protection by requiring users to provide two or more verification factors to gain access to SWIFT systems, significantly reducing the risk of unauthorized access, even if passwords are compromised. The SWIFT CSP framework mandates the use of MFA as part of its security controls. Specifically, Control 4.2 of the SWIFT CSCF (Customer Security Controls Framework) requires MFA to be used when accessing SWIFT-related applications or components, including those operated by third-party service providers.

MFA ensures that the person attempting to access the SWIFT network is indeed who they claim to be by combining something the user knows (like a password), something the user has (like a security token), and something the user is (like a fingerprint or facial recognition).

Check out, miniOrange MFA Solution

Implementation of MFA in banks can protect themselves against common cyber threats such as phishing, credential stuffing, and brute force attacks, making it much harder for attackers to gain unauthorized access to sensitive systems. Additionally, MFA helps maintain the integrity and security of financial transactions processed through the SWIFT network by ensuring that only authorized users can initiate and approve transactions, thereby preventing fraudulent activities.}

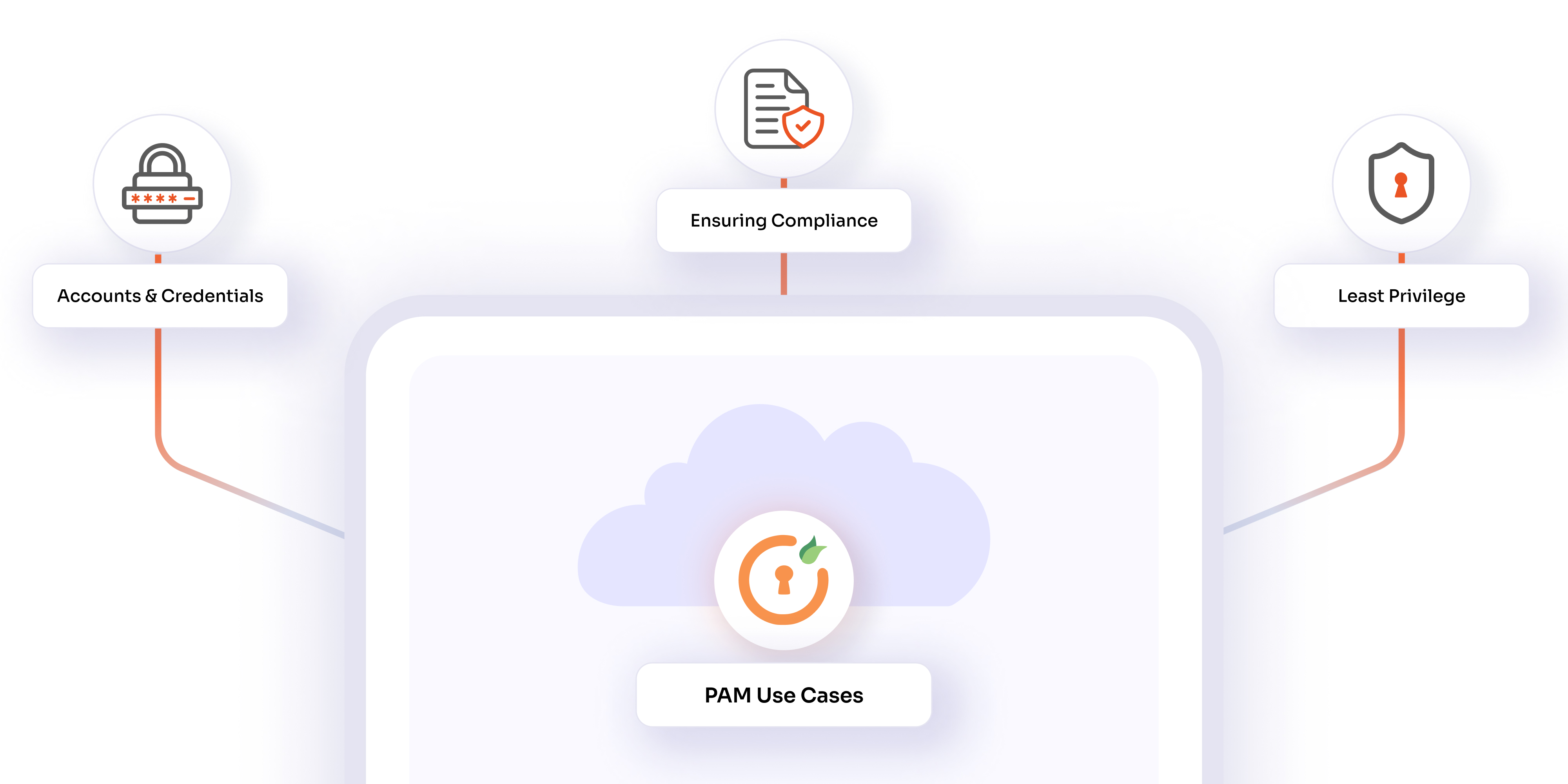

Role of Privileged Access Management (PAM)

Privileged Access Management (PAM) is an important component in securing banking systems. PAM solutions help manage and control access to sensitive systems by privileged users, ensuring that only authorized individuals can have access to critical data/resources. miniOrange’s PAM solutions offer a wide range of features that align with the SWIFT CSP framework, enhancing the overall security posture of financial institutions.

Check out: miniOrange PAM Buyer’s Guide

miniOrange PAM Features

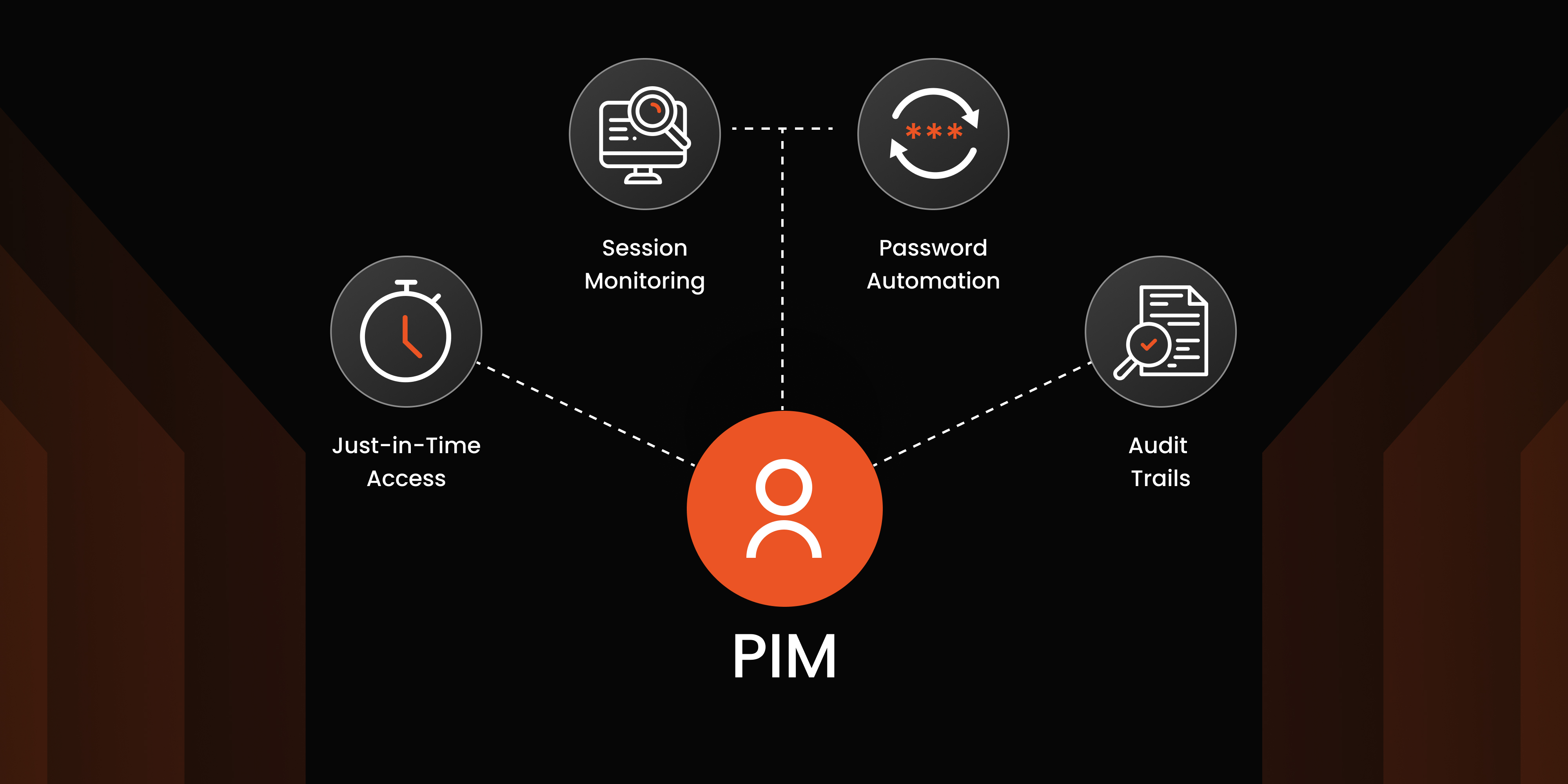

- Password Vault and Rotation: Securely manages user accounts by storing , auto-updating, and encrypting privileged passwords. This feature eliminates the need of embedded credentials and ensures regular rotation with Multi-Factor Authentication (MFA) for enhanced security.

- Session Monitor & Control: Enhance security with real-time streaming, instant termination, and compliance-ready session recordings. Monitor activities and receive alerts through a user-friendly dashboard for efficient threat management.

- Privilege Account and Session Management (PASM): Control access to sensitive assets with the Privileged Session Manager. It defines administrator access, and its duration, simplifies system access, and enforces session restrictions for robust, monitored privilege account management.

- Privilege Elevation and Delegation Management (PEDM): Assign time-limited access to restricted resources for specific users, customized to their current privilege levels. PEDM avoids granting standard users permanent access to sensitive resources, minimizing risks linked to overly privileged users.

- Endpoint Privilege Management: Protects sensitive data and prevents unauthorized access with comprehensive security across Windows, Mac, and Linux. Removes local admin rights, enforces the least privileges, and deploys endpoint security controls to mitigate the risk of security breaches.

- Just In Time (JIT) Privileged Access: Minimize security risks with dynamic, time-limited privileged access precisely when needed. JIT Access ensures as-needed basis resource availability, streamlines operations, and limits misuse potential, supporting a secure, efficient, and compliant IT environment.

- Agentless PAM: Offers a hassle-free deployment process that mitigates the risks associated with agent vulnerabilities by eliminating the need to install and manage PAM agents on each endpoint.

Implementation of PAM in Banks

Implementing miniOrange’s PAM solutions in banking systems involves several steps:

- Assessment: It evaluates the current security posture and identifies gaps in compliance with the SWIFT CSP framework.

- Planning: Development of a comprehensive plan to integrate PAM solutions into the existing infrastructure.

- Deployment: Implement the PAM solutions, ensuring minimal disruption to operations.

- Monitoring: Continuously monitor and manage privileged access to ensure ongoing compliance and security.

- Review and Update: Regularly review and update security measures to address emerging threats and changes in the SWIFT CSP framework.

Conclusion

The SWIFT Customer Security Programme (CSP) framework is required to improve the security of the global banking system. By implementing the mandatory and advisory controls outlined in the CSP, financial institutions can significantly reduce their risk of cyberattacks. miniOrange’s MFA and Privileged Access Management (PAM) solutions provide the necessary tools to help banks comply with the SWIFT CSP framework, ensuring robust security and compliance.

By leveraging these advanced miniorange features, banks can protect their sensitive data, manage privileged access effectively, and maintain the integrity of their financial transactions. Stay ahead of cyber threats and secure your banking systems with miniOrange’s comprehensive solutions.

Author

Leave a Comment