Rise of Cybersecurity Threats to Banks and Financial Institutions

It is estimated that the cost of cyber attacks in the banking sector has increased dramatically, reaching 15.4 million euros per firm yearly. Protecting the assets of the consumer is the main goal of cybersecurity in digital banking. More and more activities or transactions are being done online as more and more businesses are going cashless. Cyber crimes in digital banking have an impact on both the customer and the banks. Banks have to invest a substantial sum of money and resources in order to be able to recover data. Along with that banks also lose their customer’s trust when such issues arise.

Banking security experts today need to be familiar with a dizzying array of terminologies and methods, including Trojans, Rock Phish, phishing, pharming, spear phishing, session hijacking, man-in-the-middle, and man-in-the-browser attacks. Obtaining private user data like usernames, passwords, credit card numbers, and social security numbers is the common goal of most attack tactics, despite the diversity of the attacks. The issue stems from the fact that these credentials are all static but never change. Once obtained, the attacker can use them to pose as the customer and commit fraud.

Even though the end-consumer suffers losses, card issuers and banks will face the majority of the burden, including refunding the customer, dealing with refund fees/fines, and investigative expenses, which frequently result in reputation loss.

Thus, banks and financial institutions must have strong cybersecurity technology know-how because data breaches may make it difficult for people to trust financial institutions. If banks don’t take appropriate steps to safeguard users’ data, then it can be readily compromised resulting in many issues, such as fraud.

Why is MFA required for Banks and Financial Institutions?

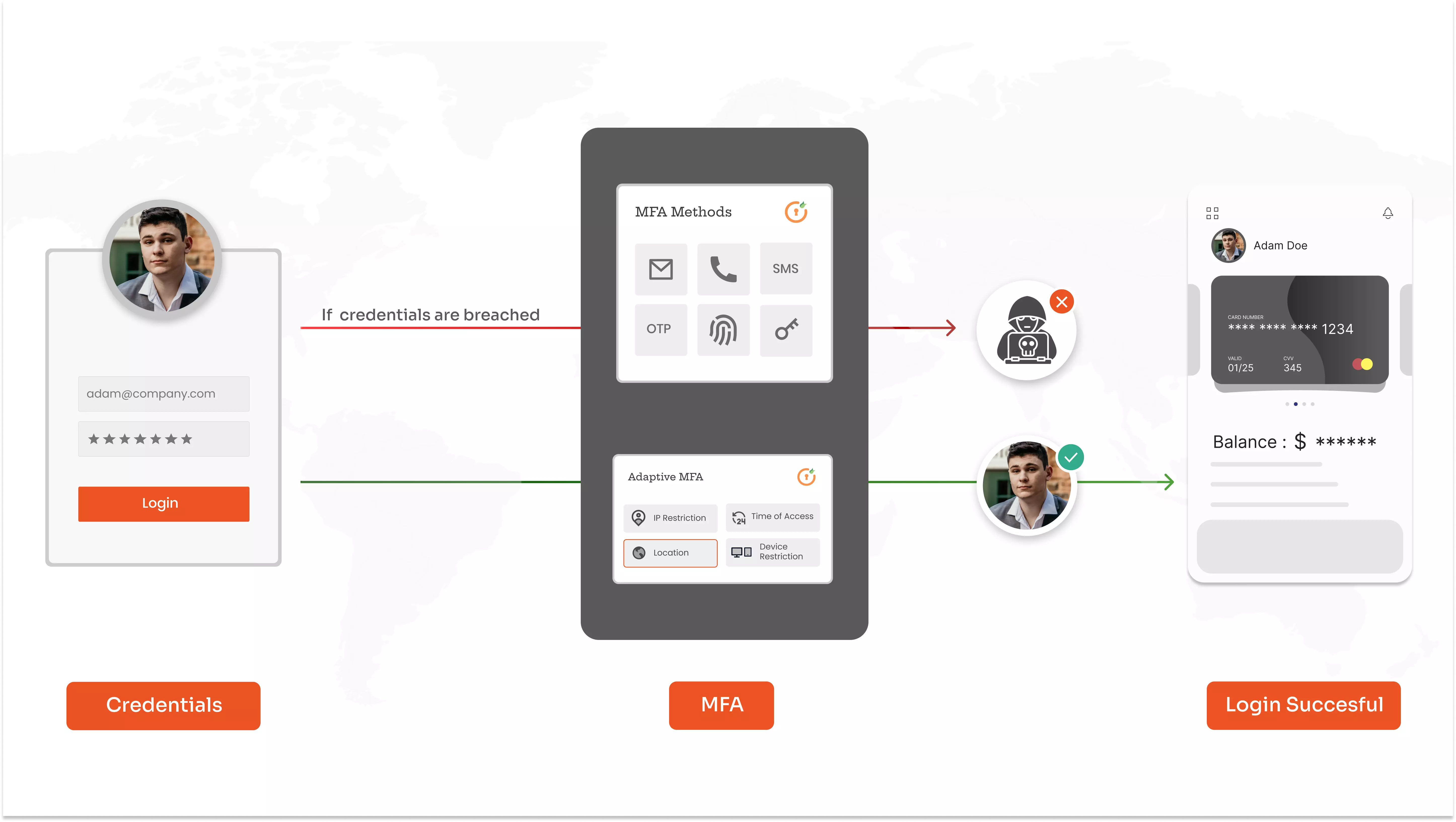

The biggest drawback of using the traditional user ID and password logins is that the passwords can be easily stolen by hackers which can cause millions of dollars in damages. Brute-force cyber attacks are a serious concern since cyber criminals can use automated password cracking tools to try different login and password combinations until they discover the proper combination. Although locking an account after a specific number of unsuccessful login attempts might aid with organisation security, hackers have access to a variety of different ways to get access to systems. This is why implementing Multi-factor Authentication is crucial for an organization as it can greatly reduce cybersecurity-related risks.

Multifactor authentication is a security measure that requires users to provide more than one piece of evidence to verify their identity. This can include something that the user knows, like a password or PIN, something that the user has, like a security token or key, or something that the user is, like a fingerprint or iris scan.

By requiring multiple forms of authentication, banks and financial institutions can make it much harder for unauthorized individuals to access sensitive data and assets. Multifactor authentication can also make it easier to track and manage user access, as each user will need to have their own unique set of authentication factors.

There are a few different ways that banks and financial institutions can implement multifactor authentication. Banks and financial institutions should carefully consider which authentication factors to use and how to best implement multifactor authentication in order to protect their data and assets. Let’s have a look at the different types of MFA methods.

Types of MFA methods

The three most fundamental categories or authentication factors are Something you know, also known as the knowledge factor; something you have, sometimes known as the possession element; and something you are, also known as the inherence factor.

- Knowledge factor: Answering a personal security question is often required for knowledge-based authentication. Passwords, four-digit personal identification numbers (PINs), and one-time passwords are the most common knowledge factor technologies (OTPs).

- Possession factor: Users must have something specific in their possession in order to log in, such as a badge, token, key or phone subscriber identity module (SIM) card. For mobile authentication, a smartphone often provides the possession factor in conjunction with an OTP app. The most common possession factor user scenarios include mobile authentication, where users receive a code via their smartphone to gain or grant access. These include text messages and phone calls sent to a user as an out-of-band method, and smartphone OTP apps.

- Inherence factor: Any biological characteristics that are verified for login by the user.

The following biometric verification techniques are included in inheritance factor technologies:

- retina/iris scan

- fingerprint scan

- facial recognition

- voice recognition

Multi-Factor Authentication (MFA) for SWIFT Banking Application

The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is the world’s top provider of secure financial messaging services. SWIFT is a global banking application that is used by thousands of banks and financial institutions around the world on a daily basis.

The SWIFT infrastructure is used to securely transmit more than 40 million financial communications each day. It allows the transfer of trillions of dollars of cross-border payments between 11,000 financial institutions in more than 200 countries with each member having its own SWIFT code.

SWIFT has been the target of attacks in recent years, with criminals attempting to send fraudulent messages through the system. MFA can help protect against these types of attacks by requiring the user to provide more than just a password to log in and greatly reduce the risk of an unauthorized individual trying to access a critical banking application like SWIFT.

miniOrange’s MFA Solution

miniOrange provides an advanced MFA solution that ensures the correct identity has access to your sensitive information.

MFA methods supported by miniOrange

miniOrange supports 15+ authentication methods that include:

- SMS and Phone Callback: Receive a text on your mobile with the information required to validate yourself for the second factor.

- MFA Apps: Receive a Time-based OTP Token (TOTP) by an external authentication app such as Google/Microsoft authenticator for secure login.

- miniOrange Authenticator App: Use the miniOrange authenticator to get your login information in the form of a soft token, push notification or a QR code.

- Email: Get your login information such as login links and password keys on your registered email address.

- Hardware Token: Use a physical USB token on your computer, which generates the required information to gain access.

- Security Questions: Answer a few knowledge-based security questions which are only known to you to authenticate yourself.

Adaptive Authentication/Risk-based Authentication

miniOrange provides an advanced form of Multi-factor Authentication (MFA) known as Adaptive Authentication.

Adaptive Authentication (Risk-Based Authentication) is a process of selecting the right authentication factors depending on a user’s risk profile defined and tends to adapt to the type of authorization factors.

Adaptive MFA authentication prompts for Multi-Authentication (MFA) based on the user’s behaviour, device IP, and geo-location, resulting in the highest degree of protection. Simply stating, authentication techniques are changed based on real-time circumstances.

Every login attempt does not have to go through 2FA with risk-based authentication. Instead, each and every transaction is analyzed and risk-assessed. In addition, a risk score is provided to determine if the transaction can be completed safely.

For example, when an employee of the bank tries to access a critical application such as SWIFT, adaptive authentication determines the risk levels based on the user’s role, resource significance, location, time of day, and also the day of the week. Based on their behaviour over time, the system may maintain track of users’ normal activities. Automatic rules will be defined based on behaviour, and authentication will be prompted accordingly. This helps to strongly verify and give access only to the required users.

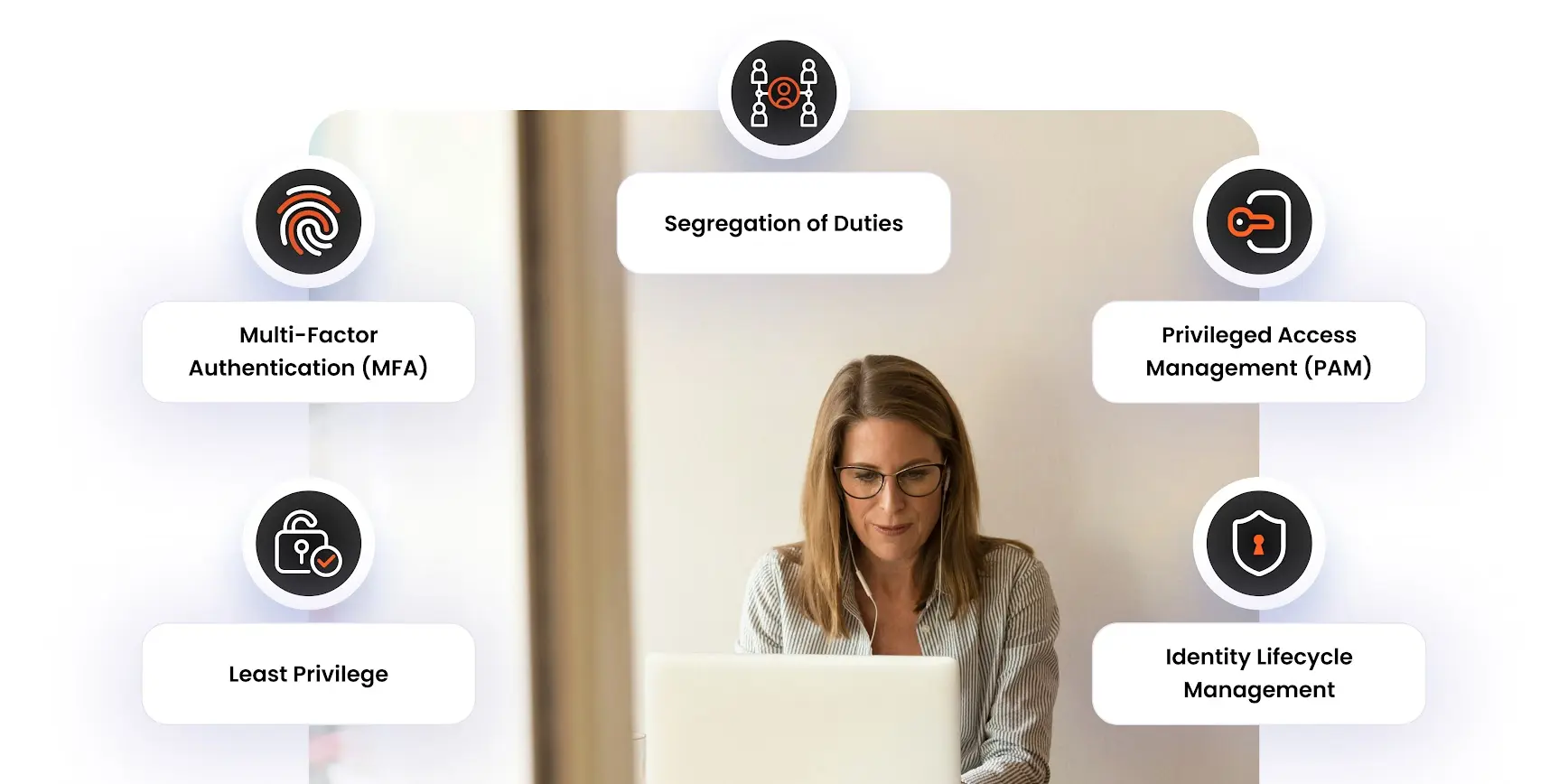

Benefits of miniOrange MFA Solution

- Enhanced Security

- Fraud Prevention

- Real-time Restriction Methods based on user attributes like:

- IP address

- Device ID

- Geo-location

- Time of access

- Improved User Trust

- Reduced Management Cost

- Increased Productivity and Flexibility

- Adaptability for Different Use-Cases

Reserve Bank of India (RBI) Guidelines

Since October 1, 2021, India’s Reserve Bank of India (RBI) has made MFA essential for transactions involving automatic recurring payments such as phone top-up, DTH, OTT, and utility bills.

Instead of the earlier, more straightforward auto-debit rules, the new regulations, which went into effect on October 1, 2021, required customers to give their consent for every recurring payment of over Rs 5,000 and to go through a two-factor authentication process each time a payment is to be made.

Banks now have to notify consumers in advance of any regular payments that are due and only deduct the money after verification, per these new regulations. Additionally, for recurring payments of more than Rs. 5000, banks are required to issue a one-time password (OTP).

The rules were put in place to make digital payments for customers safe and secure.

RBI has provided guidelines for implementing multi-factor authentication. You can find more information on these rules here.

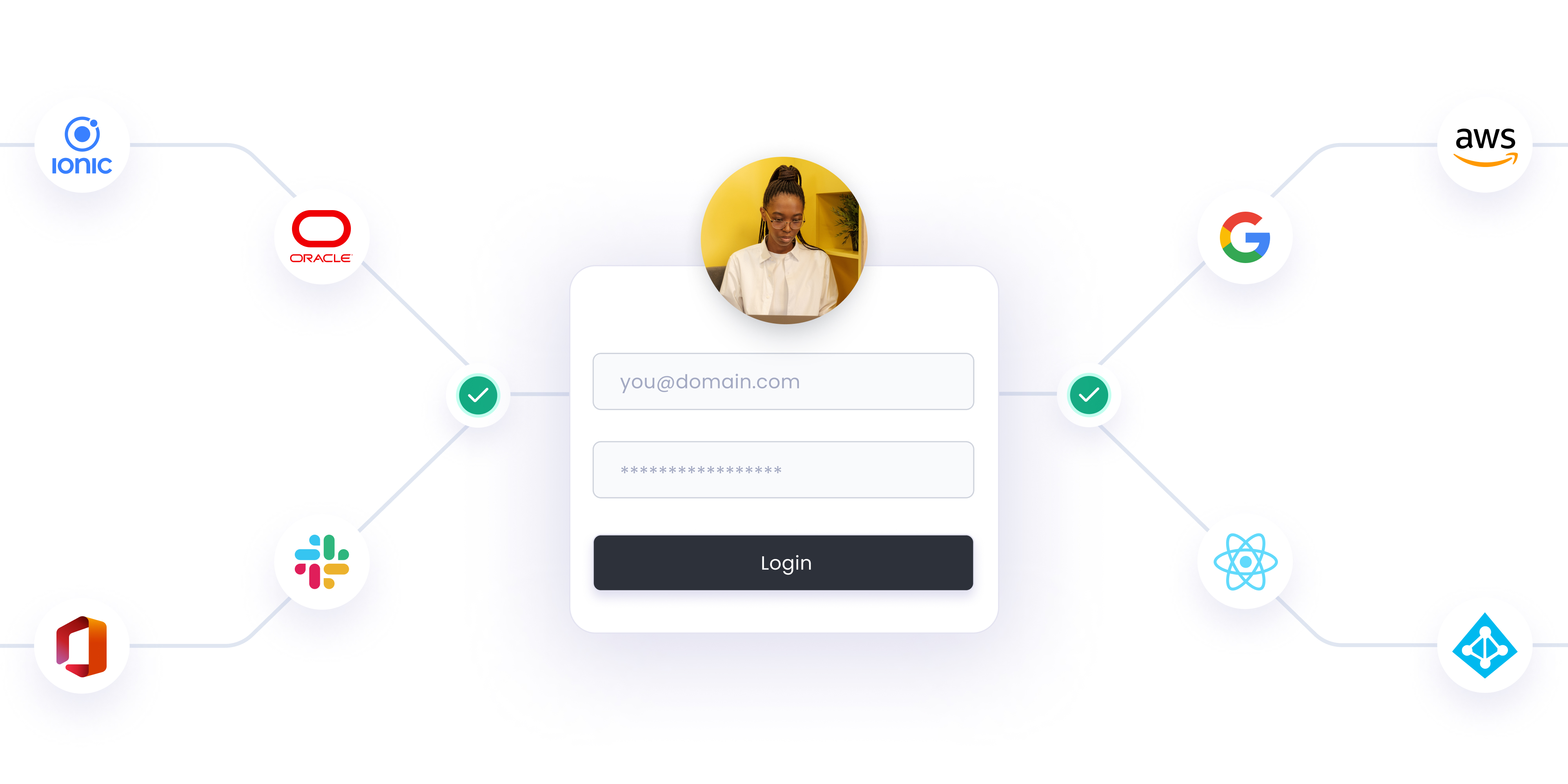

How miniOrange implemented MFA for Punjab National Bank (PNB)

As a multinational bank that is government-run, privacy is a crucial factor in every transaction. PNB ran into an issue with the Swift Application’s design inside its department that handled global transactions. International transactions necessitate the use of foreign currencies. Several SAML-compliant apps were used to manage these currencies. Even though PNB had a private network for these apps, they only had their Active Directory-based username and password authentication to verify the user identities of the workers.

As a result, a number of apps were open to unauthorized access by people or other entities that might exploit current user IDs to log into the applications. This can be extremely damaging to the organisation and its clients. PNB decided that these apps needed the Second Factor of Authentication to close these vulnerabilities in their system. Users would authenticate twice, first with their current Active Directory credentials and again with a different set of values from OTP, Google authenticator, hardware tokens, and other sources, increasing their security.

miniOrange provided PNB with an On-Premise solution for Two-Factor Authentication. This solution was critical in increasing security and preventing unauthorized access to critical applications.

You can read more on how miniOrange provided a custom MFA solution based on PNB’s requirements here.

Conclusion

Multi-factor authentication (MFA) can be an important security measure for banks and financial institutions. MFA adds an extra layer of security by requiring users to provide more than one form of authentication. It ensures that only the right people have access to the valuable assets and information of a bank or financial institution.

MFA is needed for banks to protect against various online threats, such as phishing attacks, account takeovers and several others. In this digital age, it is more important than ever to have the proper security measures in place to protect your business and customers. MFA is one of the most effective ways to protect your organization from cyber-crime.

You can sign up for a free trial account to test miniOrange’s MFA solution here or if you would like to see a demo of our MFA solution click here.

Author

Leave a Comment